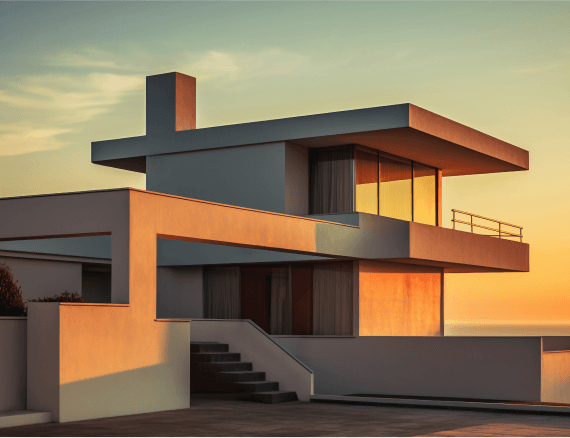

London: The Enduring Appeal of a Global Safe Haven

In a volatile global economy, capital seeks safety. London has historically acted as a "safe haven" for international wealth, and current market conditions are reinforcing this status. Despite short-term fluctuations, the fundamentals of the London property market remain exceptionally strong.

The Currency Arbitrage

For dollar-denominated investors, UK property represents a significant discount compared to historic averages due to the exchange rate. This "currency play" allows international buyers to acquire prime assets at effective discounts of 15-20% before even factoring in capital appreciation.

Chronic Undersupply

London misses its housing targets year on year. Strict planning laws, Green Belt constraints, and high land costs create a high barrier to entry for new supply. This structural undersupply insulates prices from significant corrections and drives consistent long-term growth.

Infrastructure catalysts

The "Elizabeth Line Effect" has proven that transport infrastructure drives value. Regeneration zones in East and South East London are continuing to outperform established prime areas as connectivity improves, offering higher yield potential for early movers.

Legal & Political Stability

The UK’s transparent legal title system and long leasehold structures provide a level of security that is unmatched in many emerging markets. For institutional capital, this rule of law is a primary driver of allocation to London assets.

Seeking prime investment opportunities? Review our portfolio.